July 23, 2024

February 2, 2024

June 28, 2023

Exploring Key Differences between Real Estate Investors, Professionals, and Dealers The real estate industry is a dynamic and multifaceted sector that encompasses a wide range of […]

December 15, 2022

Do you qualify for the QBI deduction? And can you do anything by year-end to help qualify? If you own a business, you may wonder if […]

October 26, 2022

You and your small business are likely to incur a variety of local transportation costs each year. There are various tax implications for these expenses. First, […]

October 4, 2022

IRS audit rates are historically low, according to a recent Government Accountability Office (GAO) report , but that’s little consolation if your return is among those […]

September 29, 2022

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that […]

September 26, 2022

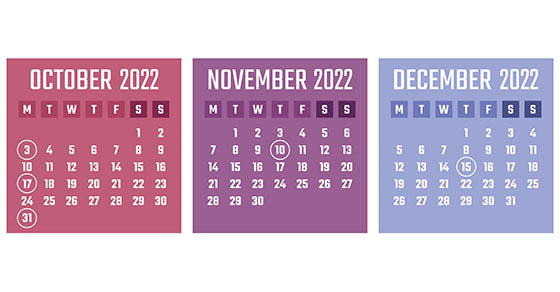

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t […]

September 19, 2022

Now that Labor Day has passed, it’s a good time to think about making moves that may help lower your small business taxes for this year […]