Can your business benefit from the Employee Retention Tax Credit (ERTC)?

July 9, 2021If you are an eligible parent or guardian, you may recognize this from the 2021 Advance CTC letter. If you do not, expect to soon receive one from the IRS. We want to help answer your questions and understand your next steps.

*All guidance provided herein is for informational purposes only and not professional advice.

What is it?

The 2021 Advance CTC is a premature payment of a 2021 tax credit that you normally claim on your tax return. This advance is part of the ARPA stimulus bill and applies only to 2021. So, what changed?

- $3,000 credit per eligible child under 18 and $3,600 for children under 6 (previously only $2,000)

- 50% paid in advance monthly payments July – December 2021 (previously applied to tax return)

- Repayment is required if the taxpayer becomes ineligible.

- Tax bill may increase due to the decreased credit claimed on the tax return.

- Phase Outs begin at $75,000 for single filers and $150,000 for those married filing jointly.

Am I eligible?

If you filed your 2019 or 2020 tax return and claimed the credit, the IRS will assume that you are eligible. You do not need to do anything to receive the advance payments as they should be sent to you automatically via direct deposit or mail. However, if you know that you cannot claim your children for 2021 or that your income will increase beyond the Phase Out, then your eligibility could change - resulting in repayment with your 2021 tax return.

Next Steps: Two Approaches:

The Conservative Approach: Opt Out

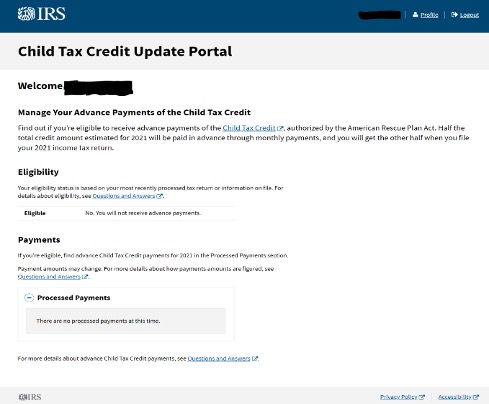

If you are concerned about owing more money with your tax return or becoming ineligible, you can opt out through the IRS CTC Update Portal. You will still be able to claim the full amount of the credit in one lump sum as part of your 2021 tax return.

*Both spouses must elect to opt out. Otherwise, half of the Advance CTC will still be paid.

The Aggressive Approach: Take the Advance

If you are confident that you will be eligible for 2021 and prefer to receive the money now, you can choose to take the advance payments. For most, this simply means doing nothing. The IRS will base your payment on your 2019 or 2020 tax return.

However, if your income decreased in 2021 or you can claim another child, you may need to update your eligibility on the IRS CTC Update Portal.

Updating Your CTC Portal

The IRS has now opened a digital portal to update your eligibility, view payment history, or opt out of the advance CTC.

If you still have questions regarding the CTC, please read our full client letter here.

You may be eligible to receive advance payments of the Child Tax Credit (CTC).